IoT payments present a future where connected devices autonomously initiate and complete transactions, offering increased convenience, efficiency, and automation in various sectors, including transportation, healthcare, agriculture, and beyond.

According to the Medici Global estimate, the market for machine-to-machine (M2M) transactions, including IoT payments, is projected to reach $27.62 billion by 2023. This growth includes both the replacement of traditional payment channels (such as credit cards being replaced by in-vehicle digital wallets) and the emergence of new payment methods enabled by IoT technology.

In this article I’d like to present what drives IoT payments and how it can shape a future of transactions and consumer behaviors where connected devices seamlessly integrate with the payments ecosystem.

What is IoT payments ?

IoT payments revolves around the intersection of two key domains: the Internet of Things (IoT) and electronic payments.

The Internet of Things refers to a network of interconnected physical devices embedded with sensors, software, and connectivity capabilities that enable them to collect and exchange data. These devices can range from everyday objects like household appliances, vehicles, and wearable devices to industrial machinery and infrastructure components. IoT devices communicate with each other and with central systems, enabling data analysis, automation, and remote control.

On the other hand, the payments industry encompasses the systems, technologies, and processes involved in facilitating money transactions between individuals, businesses, and organizations. It includes various payment methods such as physical cards, mobile wallets, online payments, etc.

IoT payments arise at the intersection of of the two, where IoT devices are utilized to initiate and process payment transactions by leveraging the autonomous capabilities of IoT devices, which collect and analyze data to trigger, verify and complete payment transactions whereas traditionally traditional payment operations are initiated and authorized by humans.

Autonomy, the key to IoT Payments

Autonomy refers to the ability of IoT devices to initiate and complete payment transactions without significant human intervention, based on predefined rules, contextual data, or analysis of collected information.

The level of autonomy determines the extent of human interaction required for the payment process :

- Level 1:Informational

The device has access to the user’s bank account but only provides information about payment-related data, such as account balance or transaction history. - Level 2: Human Authorized

IoT devices play a role in triggering the payment process based on data they collect or receive. However, human intervention is still required to authorize the payment (ex : via push notification) - Level 3: Human Verified

IoT devices have a higher degree of autonomy. They can initiate payment transactions based on collected data and deterministic conditions set by the user. (ex : low ink levels in a printer automatically triggering an order and payment for replacement ink) - Level 4: Full Autonomy

The highest level of autonomy, where IoT devices can independently initiate, verify, and complete payment transactions without any human involvement. These devices have the capability to make payments based on predefined rules, thresholds, or smart contracts.

The Full autonomous payments is the ability of IoT devices to act independently and make decisions regarding payment transactions. Autonomy enables IoT devices to initiate, verify, and complete payments without significant human intervention, based on predefined rules, contextual data, or analysis of collected information. AI can play a major role in achieving a full autonomy level.

What does autonomous payment mean

Autonomy enables IoT devices to initiate, verify, and complete payments without significant human intervention, based on predefined rules, contextual data, or analysis of collected information. Here are some important points to understand about autonomy in the context of IoT payments:

- Device Independence: IoT devices operate autonomously, meaning they can make decisions and take actions without relying heavily on human interaction or control. They have the capability to communicate, process data, and initiate payment transactions based on predefined parameters.

- Data-Driven Decision Making: Autonomy in IoT payments relies on the ability of devices to collect and analyze data. IoT devices use the data they gather from various sensors and sources to evaluate payment triggers, such as proximity to a specific location, predefined thresholds, or patterns in user behavior. This data-driven decision-making process enables devices to act autonomously.

- Contextual Understanding: Autonomous IoT devices can interpret contextual information to determine the appropriate actions related to payments. For example, a connected car can use data on fuel levels, location, and proximity to a gas station to autonomously trigger and authorize a fuel payment transaction.

- Predefined Rules and Thresholds: Devices operating autonomously in IoT payments follow predefined rules and thresholds set by users or system administrators. These rules dictate the conditions under which payments are triggered, the maximum transaction amounts, or the frequency of transactions, among other factors. The devices act within these predefined parameters to ensure control and security.

Technologies empowering IoT Payments

In the upcoming years, IoT Payments has the potential to grow and facilitate the development of new innovative payment systems based on autonomous capabilities and intelligent devices.

The increasing adoption of these devices across various industries and consumer applications will create large interconnected networks where huge amounts of data will be exchanged and processed enabling numerous automated payment scenarios based on efficient data analysis and autonomous decision making devices resulting in cost savings, improved user experiences, and enhanced operational effectiveness for businesses.

The massive available data captured via sensors and connection to other devices can be leveraged to gain insights into consumer behavior, preferences, and contextual information, allowing for personalized and relevant payment experiences. Analyzing IoT data can enable targeted marketing, fraud detection, and risk assessment, contributing to the growth of IoT payments.

For a faster and more reliable processing, IoT payments need to rely on a solid technological foundation. Fortunately the advancements in connectivity technologies, such as 5G networks and edge computing, provide the necessary infrastructure for IoT devices to communicate seamlessly and process data in real-time.

Furthermore, as IoT devices handle sensitive financial information, security and trust are critical for the success of IoT payments. Robust security measures, including encryption, authentication protocols, and secure communication channels, are necessary to protect data and ensure safe transactions. Establishing trust between users, devices, and payment service providers is crucial for widespread adoption.

Last, but not least, the integration of Artificial Intelligence will play a transformative role in enhancing the capabilities of IoT payments. AI technologies enable IoT devices to analyze vast amounts of data and make accurate predictions and decisions related to payment scenarios by dynamically adapt payment processes, optimize transaction routing, detect anomalies or fraud, and personalize payment experiences based on user preferences and historical data.

An Iot Payment Model

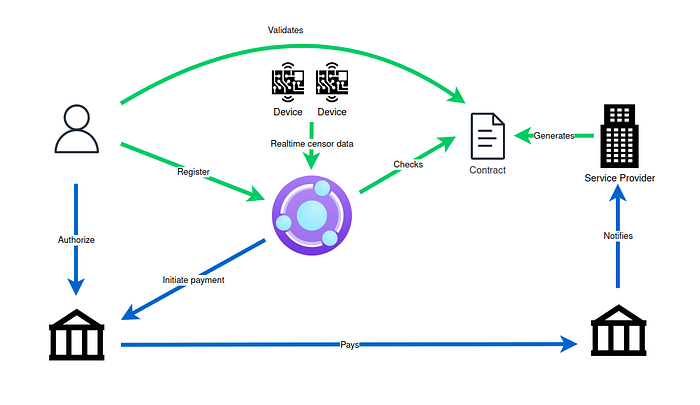

In this example, we illustrate the interactions among various participants in an IoT payment scheme, other schemes may exist and include diverse technologies such as wallets, smart contracts, etc.

The crucial enrollment phase with the service provider, IoT platform, or financial institution is not detailed here.

The onboarding phase is pivotal, involving user subscription to a service and contract validation for automatic purchases.

The client registers the IoT devices within the platform and associates the service provider’s contract. These interconnections require APIs, prior authorizations, and a shared standardized protocol, especially if the platform is independent from the service provider and IoT devices agnostic (similar to some smart home platform schemes).

During operations, devices transmit sensor data to the platform, which aggregates and analyzes it contextually. If a contract condition is met, the platform automatically initiates payment from the user’s financial institution to the provider’s financial institution, based on the contract data. Upon notification, the service provider can fulfill requested operations, such as delivery or continuity of service, as prompted by the IoT platform.

Other architectures may indeed exist, each with its unique approach, potentially without relying on central platforms or standardized protocols.

Devices might independently manage data processing and triggering payment instructions. yet scaling an IoT model with multiple devices and participants may necessitate centralization of processing for efficiency.

However, regardless of the architecture, the underlying principle remains unchanged: contextual data and constraints serve as input, processed to trigger actions based on these parameters.

Examples of IoT Payments Scenarios

Automatic printer cartridge order

In the user enrollment phase of the service, participants can join the program, regardless of the printer brand they own. During this onboarding process, users have the freedom to specify their ink preferences and associated triggers. They can define the characteristics of the desired ink, such as color and size, and set customized thresholds for reordering. Moreover, users can choose the level of automation they prefer, whether it’s conditional, allowing the printer to automatically purchase ink cartridges based on pre-defined conditions, or permissioned, requiring user approval before initiating a purchase.

For instance, if a user selects conditional automation, they might opt to automatically purchase a black ink cartridge in a specific size when the ink level in their printer hits 20%. The printer, equipped with IoT capabilities, continuously monitors ink levels and predicts when a cartridge will be depleted, either based on the number of days or printed pages, depending on the criteria selected during onboarding. Once the printer detects the imminent need for a replacement cartridge, it seamlessly triggers the purchase process.

At this stage, the system proceeds to purchase the required ink cartridge and promptly sets it for delivery to the user’s preferred address. This streamlined process ensures that users never run out of ink and experience uninterrupted printing, reducing hassles and optimizing convenience.

Smart maintenance system

The IoT-powered system goes beyond mere detection and takes proactive measures to ensure optimal performance and maintenance of equipment. By leveraging the location of the malfunctioning equipment and other contextual data, the system efficiently identifies the nearest repair center equipped to handle the specific issue. It then schedules the repair, taking into account personnel availability and the estimated availability of the required replacement parts. This swift and automated process ensures a quick turnaround time, minimizing downtime and inconvenience for users.

Moreover, the system’s intelligence is augmented by historical data and predictive analytics. By analyzing past incidents and forecasting future trends, the system can anticipate potential defects based on factors such as weather conditions, usage patterns, and wear and tear. This predictive capability empowers the system to proactively take preventive actions well in advance of the anticipated issues ensuring equipment remain in optimal working condition and reducing the likelihood of unexpected failures.

The payment process in this system is seamlessly managed by the piloting entity, responsible for procuring equipment from multiple suppliers. It facilitates smooth transactions by transferring funds from the maintenance entity to the respective supplier, as well as to the entity handling the maintenance intervention, using their preferred channels of payment.

Moreover, the system allows for the efficient repercussion of engaged fees to the ultimate beneficiary of the maintenance, whether it’s a third-party organization, a specific department, or an entire city. This transparent approach ensures that the costs associated with maintenance services are accurately allocated to the responsible party.

By streamlining payment procedures and enabling clear accountability, this robust payment system enhances the overall efficiency of the equipment procurement and maintenance process. It minimizes delays and discrepancies, facilitating smooth financial transactions between the involved entities and promoting a well-organized, cost-effective maintenance ecosystem.

Conclusion

IoT payments thrive on automation and contextual awareness, ensuring a seamless and reliable experience for individuals and organizations. By leveraging the Internet of Things and analyzing vast contextual data, payments play a pivotal role in streamlining operations. The integration of AI further enhances this ecosystem by adapting and learning expected behaviors, revolutionizing the payment landscape.

The journey towards fully autonomous IoT payments (or purchase experiences) is still in its early stages, promising exciting advancements in the future. The key drivers of this evolution are the opening of ecosystems and improved access to cross-industry data. As these technologies continue to mature and interconnect, we can expect a revolutionary transformation in the way we conduct transactions and interact with smart devices, ultimately leading to more seamless and efficient payment experiences for users across various industries.