The introduction of the Revised Payment Services Directive (PSD2) paved the way for open banking, allowing third-party providers (TPPs) to access customer payment account data with consent. Now, the emergence of the SEPA Payment Account Access (SPAA) Scheme promises to further revolutionize how payments are initiated and data is shared across Europe.

This article delves into the inner workings of the SPAA Scheme, exploring its functionalities, benefits, and potential impact on the financial ecosystem.

Understanding the Players: Asset Holders, Brokers, and Beyond

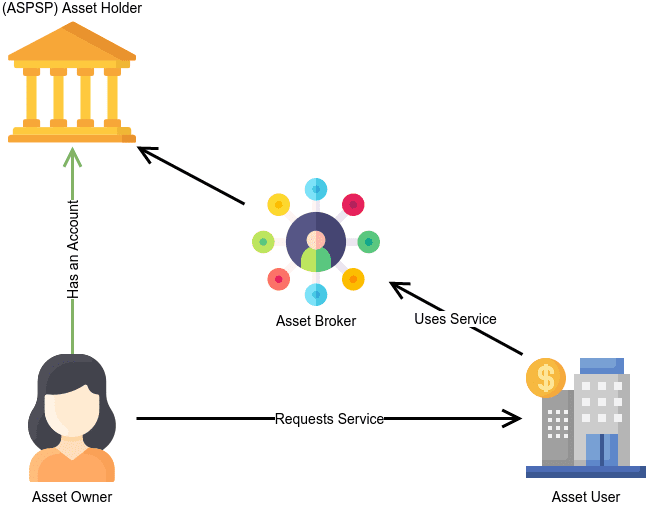

The SPAA Scheme operates within a well-defined ecosystem comprising key participants:

- Asset Holders: These are the institutions that hold payment accounts for customers, typically Account Servicing Payment Service Providers (ASPSPs) like banks.

- Asset Brokers: These are TPPs, such as Payment Initiation Service Providers (PISPs) or Account Information Service Providers (AISPs), that leverage the SPAA Scheme to access account data and initiate payments on behalf of customers.

- Asset Owners: The account holders whose data and payment initiation capabilities are being accessed through the SPAA Scheme.

- Asset Users: The ultimate beneficiaries of the services provided by Asset Brokers. In the case of payment transactions, this is typically the payee or merchant.

It’s important to note that the SPAA Scheme itself is not a payment system. It acts as a secure messaging platform that facilitates the exchange of payment account data (data assets) and the initiation of payment transactions (transaction assets) between Asset Holders and Asset Brokers.

The Core Functionalities of SPAA

The SPAA Scheme offers a standardized approach for secure communication between Asset Holders and Asset Brokers. Here’s a breakdown of its core functionalities:

- Premium vs. Basic Services: The Scheme distinguishes between “basic” services already mandated by PSD2 and “premium” services that offer additional functionalities beyond the regulatory requirements. These premium services might involve features like payment certainty mechanisms or access to data not readily available through online banking interfaces.

- Minimum Viable Product (MVP): To ensure a smooth rollout, the SPAA Scheme defines a minimum viable product (MVP) outlining a set of premium API-based services that Asset Holders must offer. The specific MVP level (MVP#1 or MVP#2) depends on the category of the Asset Holder.

Initiating Payments with Premium Features

One of the key strengths of the SPAA Scheme lies in its ability to facilitate payments with premium features. Here’s a simplified breakdown of the processing flow involved:

- Submission Request: The Asset Broker initiates the process by submitting a request to the Asset Holder for a transaction with premium features. The Asset Holder responds with either acceptance or rejection.

- Status Request: The Asset Broker can inquire about the status of a previously submitted request. The Asset Holder can also proactively push status updates, including details on payment consent and individual transaction statuses.

- Execution Request (Premium Service): Once all necessary checks are completed, the Asset Broker confirms execution of the request. This workflow is considered a premium service if not offered via standard PSD2 APIs.

- Cancellation Request: The Asset Broker can cancel all or part of a submitted request, typically in cases of fraud detection or changes in customer decisions.

A Boon for Open Payments: Unveiling the Benefits of SPAA

The SPAA Scheme holds immense potential to transform the European payments landscape by unlocking a multitude of benefits:

- Enhanced Innovation: By enabling standardized access to payment account data and facilitating premium payment functionalities, SPAA fosters innovation in the financial sector. TPPs can develop a wider range of value-added services for customers, leading to a more competitive and dynamic ecosystem.

- Greater Choice for Consumers: Consumers will benefit from a broader selection of financial products and services tailored to their specific needs. Open banking through SPAA empowers them to manage their finances more effectively and potentially access more favorable rates or features.

- Streamlined Business Operations: Businesses can leverage SPAA to automate and streamline their payment processes, leading to significant cost reductions and improved efficiency. For instance, invoice processing can become faster and more secure.

- Openness and Transparency: The standardized approach of SPAA promotes greater transparency and interoperability within the European payments market. This fosters a level playing field for all participants and reduces fragmentation.

- Stepping Stone to Open Finance: The success of SPAA can pave the way for the development of a broader “open finance” ecosystem. By extending the principles of open banking beyond payments to other financial data, consumers can gain greater control over their financial information and benefit from a more holistic financial management experience.

Addressing Potential Challenges and Ensuring Success

While SPAA presents a compelling vision for the future of European payments, there are challenges to consider:

- Security and Data Privacy: The exchange of sensitive financial data necessitates robust security measures. The SPAA Scheme emphasizes strong customer authentication (SCA) to ensure only authorized users can access and initiate payments. Additionally, clear data governance principles are crucial to maintain user privacy and trust.

- Standardization and Interoperability: The success of SPAA hinges on the consistent implementation of technical standards across all participants. The involvement of relevant standardization bodies and ongoing monitoring are essential to ensure smooth interoperability and prevent fragmentation within the ecosystem.

- Adherence and Market Adoption: Widespread adoption by Asset Holders and Asset Brokers is critical for SPAA’s success. Encouraging participation and ensuring a level playing field will be crucial in attracting a diverse range of players and fostering a vibrant ecosystem.

Moving Forward: A Collaborative Effort

The SPAA Scheme represents a significant step forward in fostering open and innovative payments in Europe. By addressing the potential challenges through collaboration among regulators, financial institutions, and TPPs, SPAA has the potential to unlock significant benefits for consumers, businesses, and the entire financial ecosystem.

Beyond the Basics: Exploring Additional Features

The SPAA Scheme goes beyond facilitating basic payment transactions. It also lays the groundwork for the development of Additional Optional Services (AOS). These are complementary services built upon the SPAA foundation that can cater to specific customer needs. There are two main categories of AOS:

- Participant-driven AOS: These are value-added services offered directly by Asset Holders to their customers.

- Community-driven AOS: These services are developed by communities of Asset Brokers or Asset Holders and can address specific industry needs or niche functionalities.

The SPAA Rulebook emphasizes that AOS must adhere to core principles like maintaining interoperability, fostering fair competition, and evolving based on market demands. This ensures a healthy and dynamic ecosystem where innovation can flourish.

Conclusion

The SPAA Scheme marks a new chapter in the European payments landscape. By enabling secure and standardized data exchange, it empowers TPPs to develop innovative financial solutions and empowers consumers to take greater control of their finances.

As the ecosystem matures and additional features emerge, SPAA has the potential to transform the way we think about and interact with payments in Europe, paving the way for a more open, efficient, and user-centric financial future.