The financial industry is undergoing a seismic shift, driven by technological advancements and evolving customer expectations. Traditional banks, once the undisputed titans of the financial landscape, are now facing intense competition from nimble, digitally native fintechs. To stay relevant and thrive in this dynamic environment, banks must embrace innovation and explore strategic partnerships.

Bank-fintech collaborations have emerged as a powerful catalyst for digital transformation, enabling institutions to enhance customer experiences, optimize operations, and unlock new revenue streams. This post delves into the intricacies of successful bank-fintech partnerships, exploring their benefits, challenges, and the key factors that drive their success.

The Rise of Bank-Fintech Partnerships: A Strategic Imperative

The financial services industry is undergoing a profound transformation, driven by technological advancements, changing customer expectations, and increasing competitive pressures. Traditional banking models are being challenged by the emergence of innovative fintech companies that are disrupting the market with their customer-centric approach and agile business models.

To remain competitive and deliver exceptional customer experiences, banks are increasingly turning to fintech partnerships as a strategic imperative. By collaborating with fintechs, banks can access cutting-edge technologies, tap into new customer segments, and accelerate their digital transformation journeys.

Key benefits of bank-fintech partnerships include:

- Enhanced customer experience: Fintechs often excel at developing user-friendly digital platforms and personalized financial solutions.

- Accelerated innovation: Collaborating with fintechs can help banks introduce new products and services to market more rapidly.

- Operational efficiency: Fintechs can bring expertise in automation, data analytics, and process optimization.

- Risk mitigation: Partnerships can help banks diversify their revenue streams and manage emerging risks.

The COVID-19 pandemic further accelerated the adoption of digital banking services, emphasizing the need for banks to partner with fintechs to meet the evolving needs of customers. As a result, the number of bank-fintech collaborations has surged in recent years, creating a dynamic and competitive landscape.

Challenges in Building Successful Bank-Fintech Partnerships

While the potential benefits of bank-fintech partnerships are significant, building successful collaborations can be complex and challenging. Several key obstacles hinder the realization of partnership goals:

- Cultural differences: Banks and fintechs often have distinct organizational cultures, which can create friction and hinder collaboration.

- Integration challenges: Integrating complex IT systems and data infrastructures can be time-consuming and costly.

- Regulatory hurdles: The complex regulatory environment can create obstacles for both banks and fintechs.

- Misaligned expectations: Differences in strategic goals and priorities can lead to misunderstandings and conflicts.

- Talent scarcity: Both banks and fintechs may face challenges in finding and retaining skilled professionals with the expertise to manage partnerships.

To overcome these challenges, banks and fintechs must establish clear communication channels, foster a culture of collaboration, and invest in the necessary resources to build successful partnerships.

Key Factors for Partnership Success: Building a Strong Foundation

A successful bank-fintech partnership is built on a solid foundation of shared goals, trust, and collaboration. Several key factors contribute to the success of these partnerships.

By focusing on these key factors, banks and fintechs can increase their chances of building a long-lasting and mutually beneficial partnership:

- Clear and Aligned Goals: Both partners must have a clear understanding of their objectives and how they align with the partnership’s overall goals. Defining key performance indicators (KPIs) is essential for measuring success.

- Strong Communication and Collaboration: Open and transparent communication is vital for building trust and resolving issues. Regular meetings and effective collaboration channels are essential.

- Shared Risk and Reward: A successful partnership involves shared responsibilities and benefits. Both partners should be committed to the partnership’s success and willing to share risks and rewards.

- Complementary Expertise: Banks and fintechs bring unique strengths to the table. Leveraging these complementary capabilities is crucial for creating a successful partnership.

- Data Sharing and Integration: The ability to share and integrate data is essential for driving insights and innovation. Secure data sharing protocols are necessary to protect sensitive information.

- Regulatory Compliance: Understanding and adhering to relevant regulations is crucial for ensuring the partnership’s legality and sustainability.

Different Types of Bank-Fintech Partnerships

There are various models for bank-fintech partnerships, each with its own advantages and challenges. Understanding the different types of partnerships can help banks and fintechs identify the most suitable collaboration model.

- Referral Partnerships: Banks refer customers to fintech partners for specific products or services, earning a commission for each referral.

- Technology Licensing: Banks license fintech technology to incorporate into their own products and services.

- Joint Ventures: Banks and fintechs create a new entity to develop and offer innovative financial solutions.

- Equity Investments: Banks invest in fintech companies to gain access to their technology and expertise.

- Strategic Partnerships: Banks and fintechs form long-term alliances to collaborate on multiple initiatives and share resources.

The choice of partnership model depends on various factors, including the strategic goals of each partner, the complexity of the collaboration, and the desired level of control. Carefully evaluating these factors is essential for selecting the optimal partnership structure.

By understanding the different partnership models and their implications, banks and fintechs can increase their chances of finding the right partner and achieving their strategic objectives.

The Future of Bank-Fintech Partnerships: A Look Ahead

The landscape of bank-fintech partnerships is constantly evolving, driven by technological advancements, changing customer preferences, and emerging regulatory frameworks. Several key trends will shape the future of these collaborations:

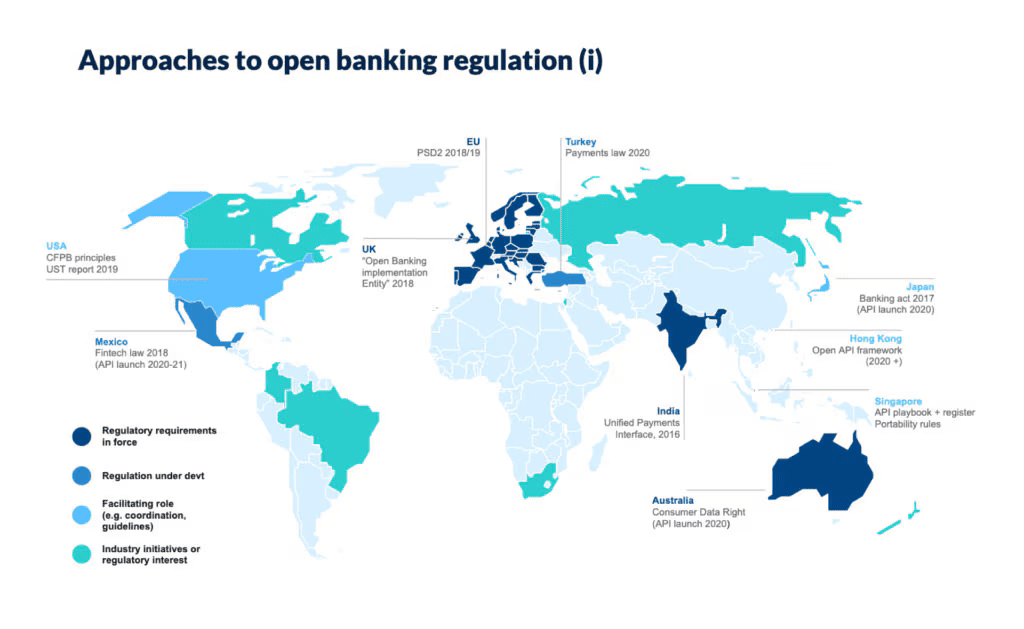

- Open Banking and APIs: The rise of open banking will create new opportunities for banks and fintechs to collaborate by sharing data and developing innovative financial products and services.

- Artificial Intelligence and Machine Learning: AI and ML will play a crucial role in enhancing customer experiences, improving risk management, and automating processes.

- Embedded Finance: Fintechs will increasingly embed financial services into non-financial platforms, creating new distribution channels for banks.

- Blockchain Technology: Blockchain has the potential to revolutionize the financial industry by providing secure and transparent transaction processing.

- Regulatory Evolution: The regulatory environment for fintechs is evolving rapidly, and banks and fintechs must stay informed about new regulations to ensure compliance.

To thrive in this dynamic environment, banks and fintechs must foster long-term partnerships based on trust, collaboration, and shared vision. By embracing innovation and adapting to changing market conditions, these partnerships can drive growth, enhance customer experiences, and create new business opportunities.

Source : Finextra

Conclusion

Bank-fintech partnerships have become essential for driving digital transformation and delivering exceptional customer experiences. By understanding the benefits, challenges, and key factors for success, banks and fintechs can build strong and enduring collaborations.

As the financial industry continues to evolve, the importance of bank-fintech partnerships will only increase. By embracing innovation, fostering collaboration, and addressing emerging challenges, banks and fintechs can create a future where financial services are more accessible, efficient, and customer-centric.